Online Scams: A Comprehensive Guide for the Non-Technical

We may earn a small fee from the companies mentioned in this post.

The digital age has made our lives more convenient than ever before, but it has also opened the door to a new breed of scammers. Online scams have become increasingly sophisticated and pervasive, leaving even the most cautious individuals vulnerable to deception.

In this blog post, we will delve into the world of “online scams: a comprehensive guide for the non-technical”, exploring the various types, how to recognise and avoid them, and what to do if you fall victim. By understanding these tactics, you can protect yourself and your loved ones from becoming easy targets.

Short Summary

Be aware of tactics used by scammers, such as phishing and social media scams.

Take proactive measures to protect personal information from online frauds including creating secure passwords and monitoring accounts.

Report any scam incidents to the relevant authorities and share knowledge with others for a safer online environment.

Understanding Online Scams

The primary types of online scams involve phishing, social media, and fake websites. Scammers use a variety of tactics to deceive their victims, often employing urgency and fear, offering deals that appear too good to be true, or making unsolicited contact.

The most effective way to guard against online scams is to become knowledgeable about these tactics, utilise strong passwords, and monitor your bank accounts and credit cards regularly.

Phishing scams, for instance, often involve scammers using fake emails, texts, and websites to trick you into providing personal information or downloading malware. Social media scams involve scammers using social media sites like Facebook and Twitter to spread fake news, offer fraudulent deals, or impersonate friends and family to steal your information or money.

Fake websites, on the other hand, can be set up to look like legitimate online stores or services, but are designed solely to steal your personal and financial information during transactions.

Phishing Scams

Phishing is a form of social engineering where scammers use deceptive emails, texts, and websites to obtain confidential information or install malicious software. These phishing attempts often involve a story designed to deceive the victim into clicking a link or opening an attachment.

To prevent falling victim to phishing scams, it’s crucial not to click on any links or call any phone numbers included in the message. Instead, contact the company directly through their official website or phone number to confirm the request.

If you become a victim of a phishing scam, it’s important to act quickly. Contact your bank immediately and provide a detailed explanation of the incident. Additionally, report the incident to Action Fraud (UK) to help combat these common online scams. By taking these steps, you can minimise the damage and help authorities track down the scammers.

You may find our blog on what is Smishing useful

Social Media Scams

Scammers often use social media platforms to spread false information, offer fraudulent deals, or impersonate acquaintances and relatives to acquire your account details or funds. They identify and contact potential victims through social media, and if you suspect any fraudulent activity, it’s important to contact your bank or credit card companies immediately.

Be on the lookout for warning signs of a social media scam, such as unusual messages or promotions circulating through a group, and verify if the social media account matches the one used normally by the brand.

One particularly insidious type of social media scam is the relationship scam, where scammers use social networks or dating websites to gain trust and ask for money. If someone you’ve only interacted with online requests a monetary transaction, it’s best to promptly discontinue communication.

Scammers employ various methods to deceive users into providing personal information, such as your name, email, password, credit card number, etc., which can be utilized to commit identity theft.

Fake Websites and Online Shopping Scams

Fraudulent websites or malicious modifications of legitimate websites are often used to obtain personal and financial information from unsuspecting online shoppers. To protect yourself from these types of scams, access your bank’s website by entering the official web address in your browser and verify the information you need through the Government’s official website.

Other types of online shopping scams include formjacking, bogus contest scams, fake shopping websites, free trial scams, fake Wi-Fi hotspot scams, fake cheque or money transfer scams, and fake travel insurance policies.

If you have been a victim of an online shopping scam, it’s crucial to report the scam to the appropriate authorities, ensure the security of your accounts, and become knowledgeable about online scams to protect yourself and others. By staying informed and vigilant, you can minimize the risk of falling victim to these scams and help make the internet a safer place for everyone.

Protecting Your Personal and Financial Information

Protecting your personal and financial information is essential in the digital age, as it helps prevent identity theft, financial losses, and other negative consequences. To safeguard your information, you should take appropriate measures such as using strong passwords, monitoring bank accounts, and adjusting privacy settings on social media.

Additionally, if you suspect malware or spyware infection on your computer, it’s important to run a virus scan and consider using a reputable security software package like Malwarebytes, or MacAfee.

Taking these precautionary measures can go a long way in ensuring your personal and financial information remains secure. By being proactive and staying informed about the latest threats and security practices, you can greatly reduce the risk of falling victim to online scams.

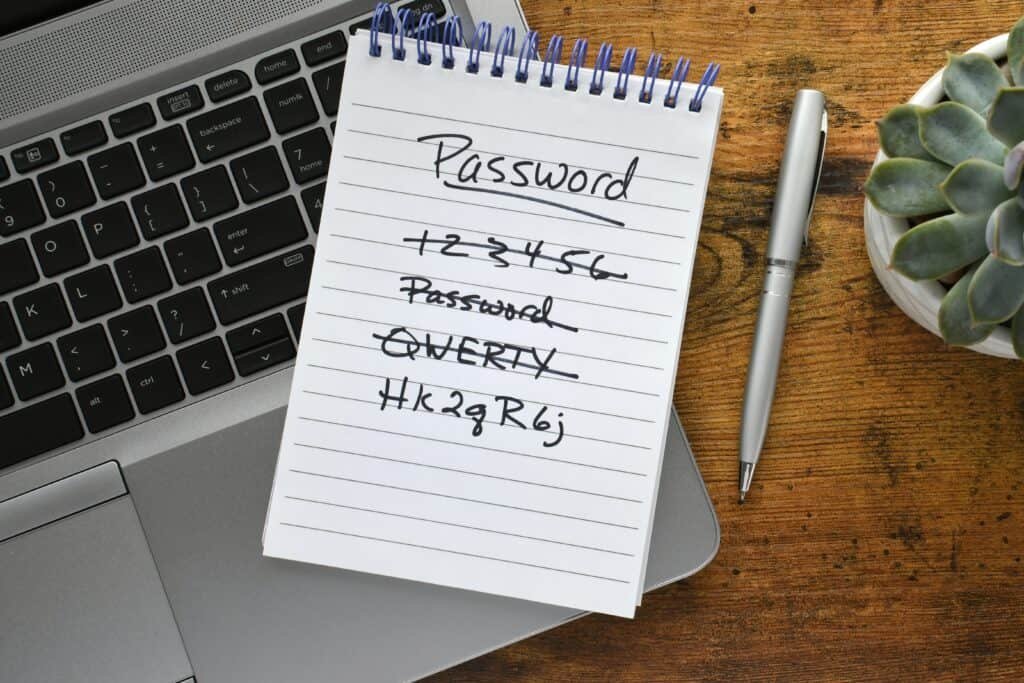

Secure Passwords

A secure password is essential for protecting your online accounts from unauthorized access. It should be at least 12 characters long and include a mixture of uppercase and lowercase letters, numbers, and special characters. It’s also crucial to use distinct passwords for each account, as using the same password across multiple accounts makes it easier for hackers to gain access to your information.

One way to ensure your passwords are strong and unique is by using a password manager. These tools securely store and manage passwords, making it easier to generate and remember complex passwords for each of your accounts. With a password manager, you can have peace of mind knowing your passwords are both secure and easily accessible when needed.

Checkout our blog on creating a secure password

Monitoring Bank Accounts and Credit Cards

Regularly monitoring your bank account, including your business account, and credit cards is crucial for detecting any potential fraudulent activity in a timely manner. By closely following the transactions and activities happening in your account, you can identify any unauthorized activities and report them immediately. This can include scrutinising credit limit increase requests, identifying ATM fraud, and tracking credit card transactions.

If you detect any suspicious activity in your bank accounts or credit cards, it’s imperative that you report it immediately to your bank or credit card company. Additionally, take proactive steps to secure your accounts and bank details, such as changing your passwords and setting up two-factor authentication. By staying vigilant and taking action quickly, you can minimise the damage caused by fraudulent activity and protect your personal and financial information.

Privacy Settings on Social Media

Adjusting your privacy settings on social media platforms can limit the amount of personal information that is publicly available, reducing the risk of identity theft and other scams. By setting your profile to private, refraining from sharing personal information, and being judicious with friend requests, you can maintain control over who can access your personal information on social media.

Additionally, you can restrict the amount of personal details available to the public by adjusting the settings on your profile. This includes setting your profile to private, refraining from sharing personal information, and being judicious with friend requests. By taking these steps, you can protect your personal information from being exploited by scammers and other malicious individuals.

Check out our latest blog on protecting yourself from HMRC scams

Recognising and Avoiding Common Scam Tactics

Being aware of common scam tactics is essential for recognizing and avoiding scams. Scammers often use urgency, fear, and too-good-to-be-true offers to deceive their victims into making hasty decisions without thinking things through. By understanding these tactics, you can better protect yourself and your loved ones from falling victim to these scams.

Some of the most frequent tactics employed by scammers include phishing, spoofing, impersonation, fake profiles, fake claims, urgency, and not allowing victims to hang up until they pay up. Additionally, scammers may use fake prizes, contests, giveaways, early investment opportunities, and charity fraud scams to deceive their victims.

Staying informed about these common tactics and knowing how to recognize them can greatly reduce the risk of falling victim to online scams.

Urgency and Fear Tactics

Scammers often use urgency and fear tactics to pressure their victims into making quick decisions without thinking things through. They may create a sense of urgency by presenting limited-time offers, false deadlines, or other methods to induce a sense of urgency. Additionally, they may use fear tactics, such as threats of legal action or other consequences, to pressure people into making quick decisions without considering the consequences.

To recognize and avoid these tactics, it’s important to be mindful of any offers that appear to be too advantageous or any requests for personal or financial information that feel dubious. If there is any doubt, it’s recommended to take the time to investigate the offer or request before taking any action.

By staying informed and vigilant, you can minimise the risk of falling victim to these scams and help make the internet a safer place for everyone.

Too Good to Be True Offers

If an offer seems too good to be true, it probably is. Scammers often use these types of deals to lure victims into their traps, requiring them to act quickly or provide personal information. Examples of offers that appear too good to be true include job offers that require no experience or qualifications, travel deals that are significantly cheaper than other offers, and product sales that offer much higher quality than expected.

To avoid falling victim to these scams, be cautious of deals that seem too advantageous or requests for personal information. Conduct research on the offer, confirm the source, and be cautious with requests for personal information.

Unsolicited Contact

Unsolicited contact refers to any form of communication that is initiated without prior permission or request from the recipient, such as personal visits, phone calls, text messages, emails, or social media messages. Scammers often use unsolicited contact to deceive their victims, making it crucial to be cautious when receiving communication from unknown individuals or organizations.

If you receive unsolicited contact from unknown sources, be cautious and take appropriate measures such as hanging up or deleting the message. If you are uncertain, it is recommended to contact the organisation directly using their official contact information.

What to Do If You’ve Fallen Victim to an Online Scam

If you’ve been scammed, it’s important not to panic. Instead, focus on taking the necessary steps to report the incident, secure your accounts, and educate yourself and others to prevent future scams. By taking these steps, you can minimise the damage and help authorities track down the scammers.

First, report the incident to the appropriate authorities, such as the Action Fraud or your local police authority. Next, secure your accounts by changing passwords and enabling two-factor authentication. Finally, share your experience and knowledge with others to help raise awareness and prevent others from falling victim to similar scams.

Reporting Scams

Reporting scams is a crucial step in helping to track and stop scammers. By informing the appropriate authorities or organisations about any scam you have encountered, you can contribute to the larger effort to combat fraud and cybercrime. In the UK, Action Fraud is the designated national reporting centre for fraud and cybercrime, and you can also report scams to your mobile phone provider or to the National Cyber Security Centre.

If you suspect that you have received a scam email or phone call, it’s important to report it to the relevant authorities, such as your local authorities, the Federal Trade Commission, or the Federal Bureau of Investigation. By reporting scams, you can help authorities track down the perpetrators and prevent others from falling victim to their schemes.

Securing Your Accounts

Securing your accounts is an essential step to take if you’ve fallen victim to an online scam. This includes changing your passwords, enabling two-factor authentication, and closely monitoring your accounts for any suspicious activity. By taking these precautions, you can help prevent further damage and protect your personal and financial information.

To ensure the security of your accounts, use strong, unique passwords for each account. Additionally, enable two-factor authentication for added security and regularly monitor your accounts for suspicious activity or unauthorised transactions. By staying vigilant and taking proactive measures, you can minimise the damage caused by fraudulent activity and safeguard your personal and financial information.

Educating Yourself and Others

Sharing your experience and knowledge with others is an important aspect of preventing future scams. By raising awareness about the various types of scams and how to recognise and avoid them, you can help others avoid falling victim to similar schemes. Educating yourself and others is essential for fostering a more informed and vigilant online community.

Methods to acquire knowledge and share it with others include keeping up with industry developments, participating in online forums and researching relevant topics.

By sharing your experiences and knowledge with others, you can contribute to a safer and more secure internet environment for everyone.

Summary

In conclusion, understanding the various types of online scams and how they operate is essential to protecting yourself and your loved ones from falling victim to these schemes. By implementing security measures such as strong passwords, monitoring bank accounts, and adjusting privacy settings on social media, you can safeguard your personal and financial information.

Additionally, recognising common scam tactics and knowing how to respond if you’ve fallen victim to a scam, can greatly reduce the risk of further damage. By staying informed and vigilant, you can significantly minimise the risk of becoming a victim of cybercrime.

Frequently Asked Questions

What are the most common scams?

The most common scams are phishing, investment fraud, advance fee fraud, and romance scams. These schemes use various tactics to take advantage of people and are unfortunately all too common today.

It is important to stay vigilant against such malicious practices in order to protect your finances and personal information.

What are the newest scams?

Scams are constantly evolving, and it’s important to stay informed in order to protect yourself. These are the newest scams to be aware of: email compromise scams, grandparent scams, friend-in-need scams, tech support scams, fake bills, fake charities, gift card scams, phantom debt collection, unexpected prize and lottery scams, phishing attacks, rental scams, and employment scams.

Keep yourself informed and protected by staying up-to-date on the latest scams.

How can I protect my personal and financial information from online scams?

Protecting your personal and financial information from online scams requires you to be vigilant and aware. Make sure you use strong passwords, use a password manager, closely monitor your bank accounts and credit cards for any suspicious activity, and adjust the privacy settings on your social media platforms.

Taking these precautions will help protect you from fraud and online scams.

What should I do if I suspect I’ve received a phishing email?

If you suspect you’ve received a phishing email, be wary of any links included in the message and do not provide any personal information. Immediately delete the email and contact the company to verify its legitimacy.

What is two-factor authentication?

Two-factor authentication (2FA) is a security measure that adds an extra layer of protection to your online accounts. It’s like a second lock on your door, making it harder for someone else to get in.

Here’s how it works in a non-technical way:

Normally, you log into your accounts using your username and password. That’s the first ‘factor’ or step. With two-factor authentication, you need a second ‘factor’ or step to prove it’s really you.

This second factor could be a code that’s sent to your phone, or a fingerprint scan, or even a facial recognition. So even if someone else knows your password, they can’t get into your account without this second factor.

For example, let’s say you’re logging into your email. You enter your password (that’s the first factor). Then, your email service sends a code to your phone. You enter that code (that’s the second factor). Only then can you access your email.

So, two-factor authentication is like a double-check that it’s really you trying to access your account. It’s a simple step that adds a lot of extra security.

External Reference Sites

- Action Fraud: www.actionfraud.police.uk – This is the UK’s national reporting centre for fraud and cybercrime. It provides a central point of contact for information about fraud and financially motivated internet crime. The site offers advice on various types of scams and how to report them.

- The National Cyber Security Centre (NCSC): www.ncsc.gov.uk – The NCSC provides a wide range of advice and information on cybersecurity issues. It offers guidance on topics such as phishing, passwords, and secure online habits. It also provides resources for different audiences, including individuals, small businesses, and large organizations.

- Get Safe Online: www.getsafeonline.org – This is a leading UK resource for unbiased and easy-to-understand information on online safety. The site provides practical advice on how to protect yourself, your computers, and mobile devices against fraud, identity theft, viruses, and many other online problems. It also offers guidance on related subjects like performing backups and avoiding theft or loss of your devices.

These sites are trusted resources that provide valuable information and advice on a range of cybersecurity and online safety topics. They can be used as references to provide additional resources.

With over three decades of experience in the heart of London’s financial sector, I have dedicated my career to the pursuit of robust cybersecurity practices and IT leadership. As a Certified Information Systems Security Professional (CISSP), Certified Information Security Manager (CISM), Certified Chief Information Security Officer (C|CISO), Certified Ethical Hacker (CEH), and Computer Hacking Forensic Investigator (CHFI), I bring a wealth of knowledge and expertise to the table.

My journey in the field of cybersecurity has not only been about personal growth but also about sharing my insights with others. As an international speaker, I have had the privilege of addressing audiences worldwide, discussing the importance of cybersecurity in today’s digital age. My passion for knowledge sharing extends to my work as an author and blogger, where I delve into the complexities of cybersecurity, offering practical advice and thought leadership.

In my role as a CISO and Head of IT, I have overseen the development and implementation of comprehensive information security and IT strategies. My focus has always been on creating resilient systems capable of withstanding the evolving landscape of cyber threats.

My Master’s degree in Cybersecurity has provided a solid academic foundation, which, when combined with my practical experience, allows me to approach cybersecurity from a holistic perspective.

I am always open to connecting with other professionals in the field, sharing knowledge, and exploring new opportunities. Let’s secure the digital world together.